The Company

INCORPORATED IN APRIL 2014

OWNERSHIP – FRANK MONDELLI B.A.Sc., MBA, P.Eng.

FINANCIAL SERVICES COMMISSION OF ONTARIO – LICENSED ADMINISTRATOR

ADMINISTRATOR LICENSED – # 12526

AUDITED FINANCIAL STATEMENTS AND AUDITED TRUST ACCOUNT – ANNUALLY

ERRORS AND OMMISSIONS INSURED – $1,000,000 PER CLAIM

What We Do

MANAGE A PORTFOLIO OF DIRECT MORTGAGE INVESTMENTS ORIGINATED BY TORONTO CAPITAL CORP.

HOLD ALL LEGAL DOCUMENTS ASSOCIATED WITH EACH MORTGAGE INVESTMENT AND MAKE THEM ACCESSIBLE TO ALL INVESTORS

TORONTO CAPITAL CORP IS A MORTGAGE BROKERAGE COMPANY THAT SPECIALIZES IN PRIVATE MORTGAGE FINANCING USING THE DIRECT INVESTOR MODEL

The Portfolio

CURRENTLY MANAGING A PORTFOLIO OF $64,000,000

- $53 Million of commercial loans

$11 Million of residential loans

Responsible for 81 individual and corporate investors - Distributed approx. $4.3M in interest income to investors in 2016

Distributions currently are approx. $530,000 per month – over $6 Million per year. - Recovered 100% of all principal, interest and penalties of all defaulted loans since inception.

- We have not had an investor complaint since inception. (references upon request)

Capabilities

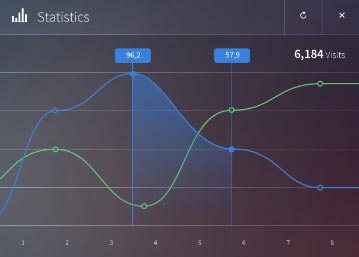

WE USE INDUSTRY LEADING SOFTWARE

WE CAN HANDLE ANY TYPE OF LOAN WITH AN

UNLIMITED NUMBER OF INVESTORS

ELECTRONIC PAYMENT OF MONTHLY DISTRIBUTIONS DIRECTLY TO INVESTOR ACCOUNTS

ELECTRONIC COLLECTION OF MONTHLY PAYMENTS DIRECTLY FROM BORROWER ACCOUNTS

MONTHLY PORTFOLIO STATEMENTS TO ALL INVESTORS

ONLINE INVESTOR PORTAL – TO BE AVAILABLE BY DECEMBER 2018

Skills We Use

Get In Touch With Us

Address:

480 Lawrence Ave. West, 4th Floor

Toronto, ON M5M 1C4

Phone numbers: t 416.225.0555 f 647.438.2066

Email:

info@avecapital.ca

Summary

FULLY TRANSPARENT REPORTING AND DISCLOSURE TO ALL INVESTORS

AGGRESSIVE AND TIMELY ACTION TO ALL MORTGAGE DEFAULTS AND PROBLEM MORTGAGES

TORONTO CAPITAL CORP. PROVIDES THE RESOURCES TO:

- Refinance borrowers and payout private investors

- Introduce investors to new mortgage opportunities to continually be invested

- Co-ordinate switching investments between investors and provide liquidity